Table of Contents

- Tarot 2025 Watch Free - Owen Jibril

- Free Printable Checklist Templates For Google Sheets And Microsoft ...

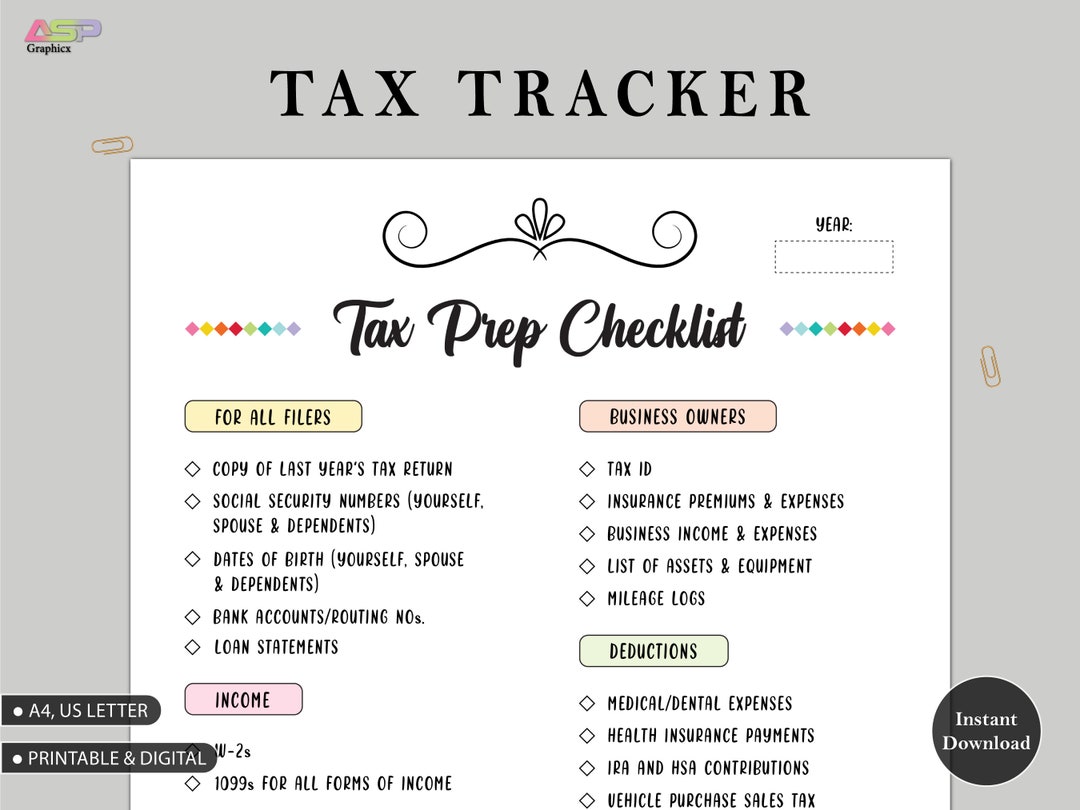

- Tax Prep Checklist Tracker Printable | Tax Prep 2023 | Tax Tracker ...

- Efficient Tax Preparation With H&R Block Checklist Excel Template And ...

- Arnold Strongman Classic 2025 Winner - Silke Ehrlichmann

- Tax Free Weekend 2024 Texas Back To School - Edee Nertie

- Tax Preparation - Livable Solutions

- North Carolina State Income Tax Rates 2024

- Nyc Income Tax Brackets 2025 - Kitti Nertie

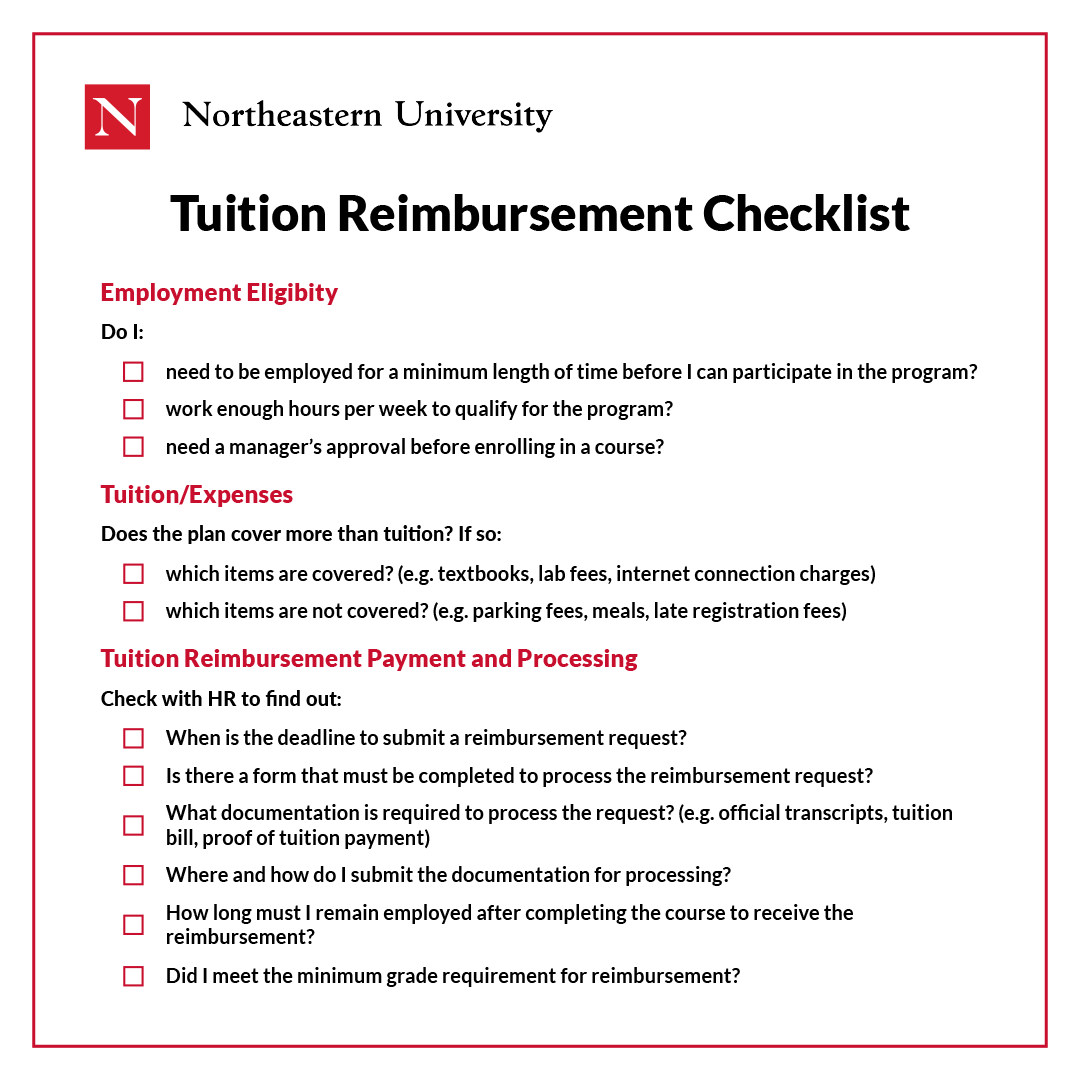

- Fedex Tuition Reimbursement 2025 - Liuka Shannon

Why Gather Documents?

- Accurate Tax Filing: Providing accurate information is vital to avoid errors, audits, or even penalties.

- Maximize Refund: Gathering all the necessary documents can help you claim the maximum refund you're eligible for.

- Reduce Stress: Having all the documents in one place can reduce stress and anxiety during the tax filing process.

Documents to Gather

- Income Documents:

- W-2 forms from your employer

- 1099 forms for freelance or contract work

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Deduction Documents:

- Receipts for charitable donations

- Medical expense receipts

- Mortgage interest statements (1098)

- Property tax statements

- Credit Documents:

- Child care expense receipts

- Education expense receipts

- Retirement account contributions

Tips for Staying Organized

- Create a Folder: Designate a folder or file to store all your tax-related documents.

- Scan Documents: Scan your documents and save them digitally to reduce clutter and make them easily accessible.

- Use Tax Software: Utilize tax software like TurboTax or H&R Block to guide you through the filing process and ensure accuracy.

By following this guide, you'll be well-prepared to tackle the tax filing process with confidence. Stay organized, and you'll be on your way to a stress-free tax season.